Story 33 of 52

By M. Snarky

Politicians. They’re just built different. From what I can gather, their (he/him/his, she/her/hers) “job” consists of the following:

- Convincing the people that they should be elected mostly because of some sort of affinity for something that the people care about (based on polling, of course): a strong military, American jobs, the economy, entitlements like Social Security, Medicare, etc.

- Convincing the people that they need to be protected from some bogeyman du jour, often made up out of thin air, but generally some evil foreign entity.

- Convincing the people that the opposing political party is to blame for everything bad that is happening while also engaging in bad things themselves.

- Convincing the people that raising taxes (i.e., taking even more of your money) is a patriotic thing to do because it helps out our country, our sick, disabled, poor, and elderly in one form or another.

- Convincing the people that they are getting the biggest slice of the tax dollar pie as possible (i.e., government handouts).

Being that most politicians started out as lawyers, they are highly skilled at this convincing business. Maybe there is some truthiness to some of this convincing, but the jury is still out regarding actual truth. In reality, much of it are noble lies.

What politicians avoid talking about is their cut, er, I mean the cost of running the government, whom, apparently by design, have made themselves the ultimate middlemen because nothing happens unless they get their cut first.

You work. The government takes some (too much, actually) of your money in the form of taxation. The government divvies up the tax money amongst the various departments. In the meantime, throughout this entire divvying process, they always get their cut, and they always take their cut.

Now I’m going to use some very simple math here to prove my point because I’m fairly good at simple math. I also like to use infographics to support a topic, so here we go…

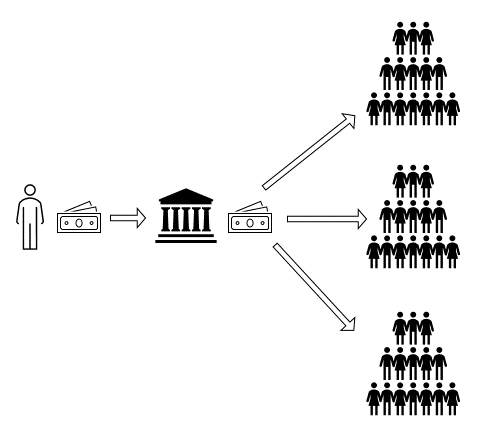

I think this is how most people think the government works:

The tax dollars flow in and are distributed to the various programs. The various programs assure that the recipients get their money.

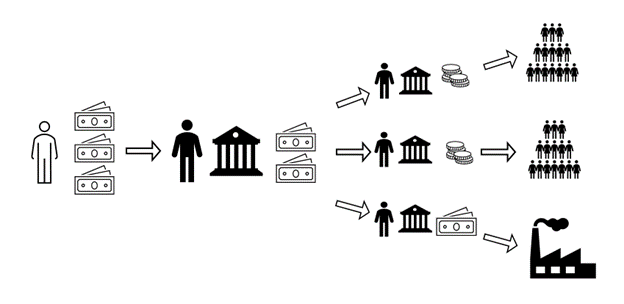

But this is how the government actually works:

You see, the tax dollars flow in and are distributed to the various departments who then distribute it to the various programs, with each level of government taking their cut along the way before the money finally gets to the recipient who, by the way, is not always a sick, disabled, poor, or elderly person as you have been led to believe. Recipients also include multi-million dollar incorporated farms and billion-dollar industries, like Big Ag, Big Pharma, Big Oil, the automotive industry, the aerospace industry, and various military industrial complex companies to name a few. I abhor this last point because I cannot stand the thought of my tax dollars going into the coffers and pockets of wealthy businessmen.

The politicians will tell you that those companies need the tax money to keep Americans working, stay competitive, and “create jobs,” as the popular political speech goes. This also happens to go directly against free-market principles and the government should not be meddling in this space – let the market (i.e., the people) figure out who the winners and losers should be – not the politicians receiving massive donations from these large corporations. But they do, and this meddling skews basic economics so much so that a rocket scientist can’t even figure out the math.

Many (too many, in my opinion) of your tax dollars get consumed by the black hole of bureaucracy itself and, to me, it appears to be an inverted Ponzi scheme. Or maybe an organized crime syndicate.

The actual percentage of the government cut are hard to track because the black hole of bureaucracy is also really good at obfuscating this kind of information, but it appears to be somewhere “estimated at about 5%,” according to the Cato Institute. I know what you’re thinking, “Shut the hell up, Snarky, it’s only 5%!” To which my reply is, 5% of the annual U.S. government budget of $6.75T (that’s trillion, with a “T”) is $337.5B, some of which, by the way, has to be borrowed because the government has a spending problem – oops – I meant to say because of budget deficits. Hmm, the last time I was in a budget deficit I ended up in bankruptcy court.

So, $337.5B divided by the 2025 U.S. population of 348M (rounding up) is $970 (rounding up again) for every man, woman, and child in this country. Okay, so I’ll just write out a $970 check for everyone in my household to the IRS and I’m done for the year, right? Not so fast, Snarky: this math is much, much too simple – you’ll need to use the official U.S. government math to get it right or you risk having your assets seized and going to prison. You see, you’ll have to apply the 6,871-page U.S. tax code (75,000 pages after the U.S. Treasury’s official interpretation of the tax code) to figure out who actually pays what, plus file your annual tax return. This is absolutely ridiculous and borders on insanity. This is all in an attempt to make sure that you pay your ever increasing “fair share” of taxes which never actually feels fair at all.

In the meantime, city, county, state, and federal politicians are all perpetually scheming on how to take even more of your money for more government jobs programs which will also cost more money in and of themselves. Stuff like increased or new sewer taxes, refuse taxes, energy taxes, toilet taxes, storm water runoff taxes (yes, Los Angeles taxes us for rainwater), ad infinitum. Us taxpayers are perpetually under attack and will die a death of a thousand taxes. Keep in mind that these are also the same people that can vote to give themselves raises. Try to do that that at your job.

In reality, it is glaringly apparent that we can’t afford ourselves anymore, so maybe it’s time to apply some basic economic principles to the government, like cutting a lot of unnecessary expenses, for example. But we will get convinced that this can’t be done because government math is obviously different than all other mathematics combined – including rocket science.

One last point here is who do you think those millions of city, county, state, and federal government workers are going to vote for; the politician talking about cutting the size, scope, expense, and power of government, or the politician championing government jobs and how they must be protected and even expanded? Unfortunately, it’s the latter, not the former. Obviously.

Don’t get me started on government employee labor unions and collective bargaining agreements where the taxpayer is virtually powerless. This, however, is simple math: They demand a raise and/or more benefits or threaten to go on strike, the politicians capitulate, and in the end, you’re going to pay more taxes.

If “Taxation without representation is tyranny,” how is representation with ever increasing taxation not outright theft/coercion? How about some representation with less taxation? Just asking questions.

Maybe the politicians should just be called Ultimate Meddlemen?

Instagram: @m.snarky

Blog: https://msnarky.com

©2025. All rights reserved.