Story 51 of 52

By M. Snarky

Selling or buying a house should not be as complicated or as protracted as it is, but this is what happens when the regulators make up the rules and regulations, and, um, regulate things. It appears to me that the rules are primarily intended to extract as much money as possible from your bank account during the process. For example, this is the fee list from the house we are currently financing:

Title – Closing/Escrow fee

Title – Courier/Messenger Fee

Title – Document preparation fee

Title – Loan Tie In Fee

Title – E-Recording Fee

Appraisal fee

Lender’s Title Insurance Fee

Owner’s Title Insurance Fee

Archive Fee

Messenger Fee

Wire Fee – Escrow

Wire Fee – Title

Originator Compensation to Lender Fee

Underwriting Fee

Credit Report Fee

Tax Service Fee

Recording Fees

County Taxes

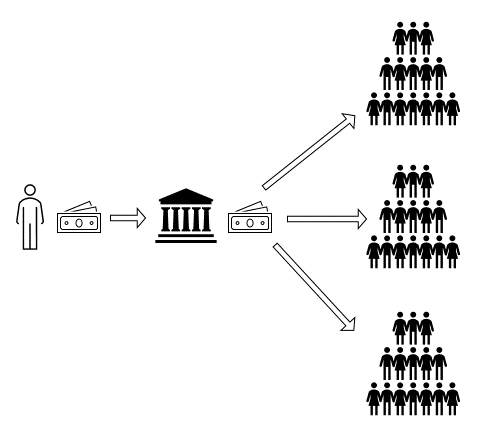

Courier and messenger fees—really? All of the paperwork thus far has been electronic! Anyway, to comply with all of these rules and regulations, escrow is part and parcel of buying and selling real estate and is something that cannot be avoided: It is deliberately and unavoidably baked into the process, I think, mostly to benefit the banks who apparently consider real estate buyers and sellers as ATM’s.

Now imagine this: You’re in Tiffany & Co. to purchase an engagement and wedding ring set for the love of your life. The ambient music is pleasant, and your inner voice sings along with the tune as you tap your foot in time. You peer into the expertly lit glowing cases of exquisite gleaming jewelry and spot the perfect set.

The Tiffany’s associate pours you a glass of Cristal champagne and describes the ring to you in detail. She talks about the rare jewels and the platinum setting and the quality and the famous Italian designer and slips in that the traditional budget guidelines suggest spending 2–3 months’ salary. For a man that makes $100K a year, this “suggestion” equates to $25,000, that is, as long as you don’t cheap out. Makes me wonder if the jewelry industry invented this budget guideline. Also, $25K seems like a lot of money for something that fits on a finger and has no other practical use than to indicate to society that someone is married, happily or otherwise.

You begrudgingly agree to the exorbitant spending guideline, but since you don’t have $25K cash sitting around in your checking account, you opt for Tiffany’s financing at 25% APR for 5-years. You fill out the 75-page application (is it really necessary to take your fingerprints and ask for your blood type, dental records, and sexual orientation?) and provide the requisite three personal references, you know, just in case you turn out to be a deadbeat and they have to send out Vito and Tony to, um, collect the merchandise.

The Tiffany’s associate never talks about how you’re also financing the sales tax, and it just becomes a line item on the contract:

Fancy Ring: $25,000.

9% Sales Tax: $2,250.

Net Sale to Finance at the Bank of Tiffany: $27,250.

The financial reality is that you’re going to pay $799.82 per month for 5-years, and now that fancy $27,250 ring is going to cost you $47,989.41. I certainly hope the marriage outlasts the monthly payments. Realistically, you can buy a decent new car for $47,989.41, which seems to be much more practical purchase.

Three hours later, the paperwork is done, the contract is signed, and the fancy ring goes into the fancy Tiffany Blue box…but instead of handing the ring over to you, the associate puts the ring into the safe for 30-days.

In that 30-days, they’ll comb through your application. They’ll call your bank, and call your references, and call your boss and ask if you’ve ever been employee of the month. They’ll call your doctor and make sure that you didn’t lie about your blood type. They’ll call your kindergarten teacher and ask about your attendance and academic records. They’ll call your auto mechanic to make sure that your car maintenance hasn’t started slipping. They’ll even call your mother to ask if she approves of the person you intend to marry.

Indeed, you do not get what you were hoping for—like that killer dopamine hit or the instant gratification rush of holding the Tiffany & Co. ring of your dreams in your sweaty little hands NOW! Instead, you get vetted first, and are forced to wait for delayed gratification later. If everything checks out, on day 30 you get the ring and might possibly live happily ever after. If not, you get nothing but a negative hit on your FICO score.

The previous scenario would be ridiculous and outrageous if retail purchases actually had to go into escrow, right? However, when it comes to buying a house, this is exactly how escrow works—you agree to pay for a house now, but you do not get the house until much later, that is, if you’re lucky enough to survive what the Real Estate Industrial Complex throws at you. This is how escrow operates.

In the meantime, while “in escrow” (interchangeable with “in exile,” if you ask me) you are filling out reams of paperwork, and it just keeps coming at you faster and faster, and you find yourself jumping through flaming hoops like a circus chimpanzee on Heisenberg’s Blue Sky crystal meth. You’ll have little time for anything else. You may need to resort to using performance enhancing drugs just to keep up with it…Blue Sky, anyone?

Throughout this entire escrow process, there are all sorts of tripwires and pitfalls and land mines that can blow the entire deal up in your face. One missed deadline or a bad report or one lost document or one missed signature or one single disagreeable person in the chain will bring the entire gargantuan escrow machine to a grinding, screeching halt. Of course, everyone will blame you.

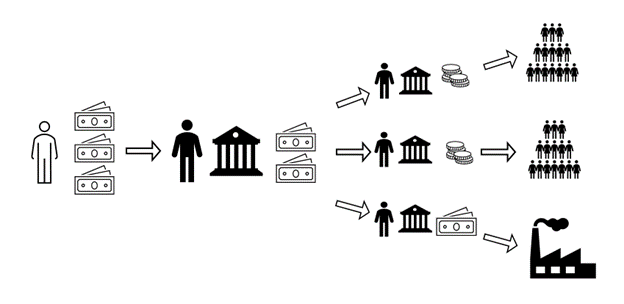

Then there are the inspections of various sorts, and the appraisals, banks, lenders, insurance, current bank and savings account balances, current credit card balances, three months of banking records and five years of tax returns, plus all of the city, county, state, and federal forms to fill out, and more contingencies than you can shake a stick at, all of which have additional fees, of course.

Then you have the throngs of brokers, agents, sellers, buyers, contractors, CPAs, etc., all with their hands out as you walk down the long line of them doling out their various fees. They are all very friendly and professional and smile and shake your hand and congratulate you as they extract their cut from you. I tried standing at the end of the line to get mine too, but by the time I got there, the bank account balance was $0.

I blame the lawyers and the bankers and the politicians for purposefully wedging themselves between me and the purchase of a house and forcing me to pay all of them while I’m also obligated to endure all of this escrow paper shuffling voodoo nonsense. Makes me wonder what the environmental impact of escrow is. I’m guessing it’s the size of a house.

When escrow hopefully eventually “closes” (suggesting here that escrow is in-fact an open wound), there will be much relief. It will also be a time to celebrate surviving and enduring the hellish escrow process, er, change that to, it will also be a time to celebrate a new home. Cheers to that!

Oh, and I hope the person who invented escrow lived a short and miserable life.

Instagram: @m.snarky

Blog: https://msnarky.com

©2025. All rights reserved.